If you get paid irregularly then you need to work on getting bills paid weekly. You may have to pay a prorated amount on your next bill so clarify that when you contact them. Most do not have any issues in doing that. You can also request a due date change from your service providers. The important thing is to track it so that you don’t spend the money. You can either actually pay it early or leave the money in the account for when you pay it. If you pay all the bills due in that cycle as I have explained, write it down for which paycheck you can pay it and get it paid ahead of time.

Then when it is due and comes out, all the money is in the account. Now you won’t actually send the half payment but write it in your register and track that it came out. In that situation, pay half out of each check. This does happen from time to time that you will have a bill that is larger than one paycheck, like your rent or mortgage. What if I can’t pay all the bills with that one paycheck? This works for a bi-weekly or twice month pay schedule. The bills due at the beginning of the next month get paid out of the last paycheck of the month. The bills that are due at the end of the month get paid from your first paycheck. It may take a month or longer to get on this schedule because you may have to pay some bills twice in one month to get there.īut once you do, you will start paying bills early instead of late. Okay, this is the schedule that I want you to achieve if you get paid twice a month. Then take a different color and highlight your last paycheck and all the bills due from the 1st-15th. I want you to take one color and highlight your first paycheck of the month and then the same color highlight all the bills that are due from the 15th-the last day of the month. Okay this is where it can get confusing but once you figure it out, it’s super easy. I want you to write out all your pay days and bills on the dates that they are due. If you want it to be pretty, then make it pretty. It can be a wall calendar or a sheet you print off the internet, Excel or Word.įind something that will motivate and inspire you. Once you have all your bills and due dates together, grab a calendar. You can figure the rest out on your paycheck budget sheet. If you have a special thing come up that month, like a birthday, hair appointment, or holiday, be sure to put that on the calendar. You can if you like but what I really want you to figure out at first is when to pay certain bills. Now as you are setting it up at first, you don’t need to worry about putting all the things on it like saving and sinking funds.

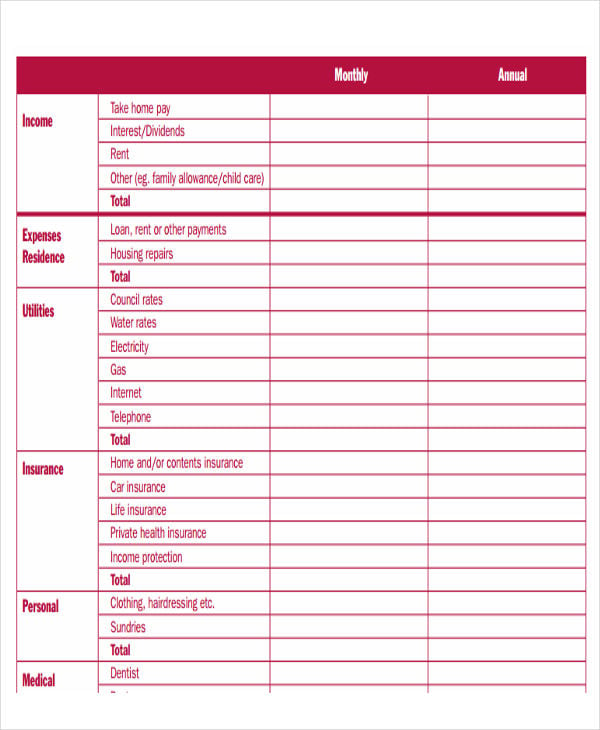

You can also separate your list by fixed due dates and ones that the due dates vary. So, you want to make sure that you have all your bills and their estimated amounts along with your income in one place. That is the first step in making your budget. It is important to track your spending before putting your calendar together. The next thing you need to do is list out all your month bills and their due dates. This is important for when you determine when to pay each bill. The first step is writing out when you get paid on the calendar. You can set up automatic payments and not worry about if there will be money for it or not. The really great thing about making a budget calendar is once you get in the habit of knowing when to pay your bills, it stays the same month to month. You will even start to notice as you pay off debt and have less bills due each month. It will help you track your progress visually which will help keep you motivated. plan for holidays and birthdays in the month.It helps you stay organized and manage your budget better.Ī budget calendar is the backbone of your budget and actually sticking to it. It will help you manage due dates and keep track of what you have paid. It makes it so easy to figure out when to pay which bill. Using a budget calendar is essential when budgeting by paycheck.

Budget calendar excel free#

You can find a printable budget anywhere including free printables online or even a budget calendar in excel or Word. You can even put it in your budget planner or hang it up where you can be reminded of what to pay and when. You can use any calendar you like, just find and use one that works for you. A budget calendar is a regular calendar but used for the purpose of tracking your bills, paychecks, and due dates.

0 kommentar(er)

0 kommentar(er)